Illinois Solar Tax Incentives Have Never Been Better . . . and Likely Never Will

by Paul J. Rozek, CPA, CFP | Selden Fox

In a continuous effort to evaluate their energy costs, owners of commercial and rental property alike are often drawn to the altruistic and sustainable features of solar energy. The reliability and longevity of solar panels have never been greater, and the costs to produce and install a solar array continue to fall. The investment in a solar array can become very attractive for building owners once the numerous tax credits and incentives available at both the federal and state level are taken into account.

Modern Photovoltaic arrays will continue to produce 80% of their initial power well into their 25th year. This lifespan combined with government incentives can turn a large expense into an investment that will pay for itself inside of a five-year window, with steady cash flows decades into the future.

Credits at the Federal Level

Section 48 provides an Investment Tax Credit (ITC) that will cover 30% of the costs of solar projects—along with other energy efficiency property improvements—begun before December 31, 2019. There is no cap to the credit, but for projects beginning after December 2019, the available percentage will begin to decrease eventually landing at just 10% for projects beginning in year 2024 and after.

The property and installation eligible for the credit includes storage devices, power conditioning equipment, transfer equipment, pipes, ducts, and property solely related to the functioning of these items. Solar arrays are frequently installed in coordination with a new roof, and it is possible that the cost of the roof, depending on its characteristics and adaptations, could qualify for the credit as well.

While the credit covers 30% of the cost of the project, the depreciable tax basis must be reduced by 50% of the credit claimed. This means that for every $100 spent on the project, $85 will be available as a tax deduction through depreciation (more on that later). The credit is available to offset the previous year’s liability, or future tax liability if it cannot all be used in the current year.

Incentives at the State/Local Level

In Illinois, owners of solar panel systems receive Solar Renewable Energy Certificates (SRECs) based on the expected production of the system over 15 years. For every megawatt-hour produced by the solar system, the owner receives one SREC, which can then be sold at a price set by the Illinois Commerce Commission and the Illinois Power Agency. While based on the expected production of the system over 15 years, the payments to the owner are front-loaded and paid over the first five years once the system comes online. Currently, the value of SRECs in relation to the project cost amount to about 25% of system cost, received over the five-year period.

In addition, Illinois’ largest power companies—Ameran and ComEd—recognize that the growth in solar will come with an increased need for their systems to be more flexible in grid management. To assist with this, they offer rebates of $250/kW for smart inverters commonly installed as part of a solar project. This applies to projects up to 2 MegaWatts in size. For reference, a 1 MW solar array would cover an area between three to five acres.

Depreciation Tax Incentives

With the Tax Cuts an Jobs Act of 2017, Bonus Depreciation has again been broadened and extended to 100% of qualified property placed in service before December 31, 2022. According to Sec 168, equipment which uses exclusively and directly solar or wind energy to generate electricity is assigned a five-year asset class life and is thus eligible for 100% bonus depreciation. Keep in mind, however, that your basis in the property must be reduced by 50% of the ITC that was claimed, as well as the Smart inverter incentive received, effectively reducing your eligible expense.

On the state level, Illinois has NOT decoupled from the Federal 100% bonus depreciation, so this depreciation benefit applies at the state income tax level as well.

Example

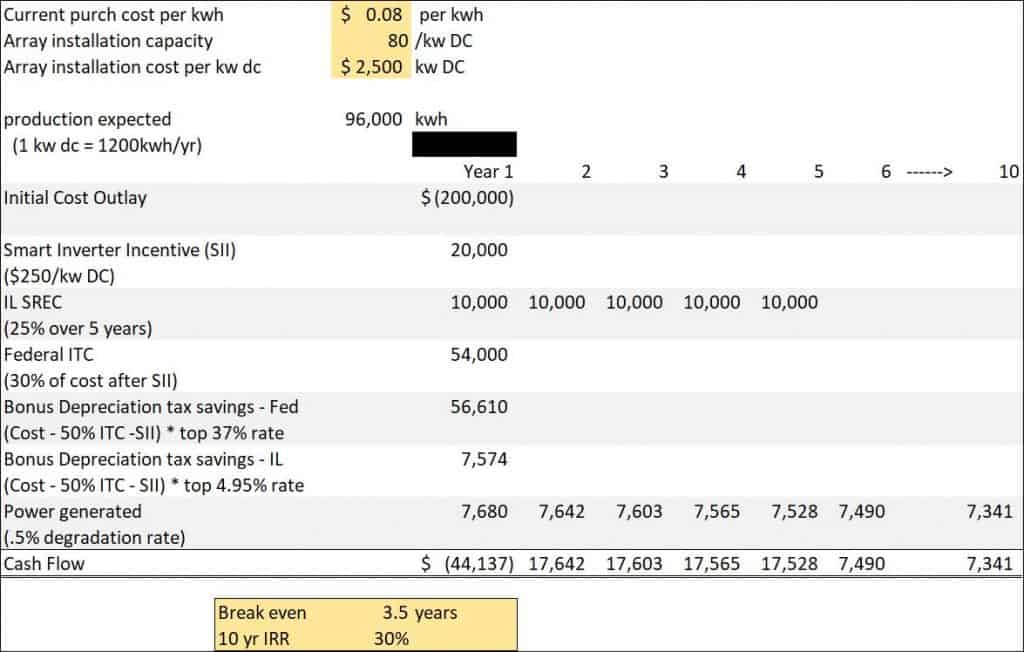

Taking all credits and incentives into account, what was once a daunting expense of “going green” becomes an opportunity for a company to obtain a renewable, sustainable energy system, at a fraction of the actual cost. Below shows a rough example of a relatively small solar array, where the initial investment is paid back within four years, and which boasts a 10-year IRR of 30%.

This is a fairly rough illustration which eschews minor items such as changes in power rates, negligible maintenance costs, and inflation, for the sake of simplicity. However, the three most salient points for a business owner are the following:

- The business or property owner is acquiring an asset valued at $200,000, for a cash outlay of slightly more than $44,000 without any financing.

- The project, besides providing a hedge against any rise in energy costs, is breaking even within four years, and will be providing cash flows for 25 to 30 years thereafter.

- This accelerated payback period has a limited window: the ITC decreases after 2019, bonus depreciation benefits decrease after 2022, and SRECs will become less valuable as more solar projects come online.

Since there is such a large “first mover advantage” to undertaking solar projects in Illinois, if you have additional questions about the tax incentives available, please contact us to discuss. If you have interest in how a solar array would impact your bottom line cash flow, we can help connect you with local solar energy companies that can provide you with a detailed technical analysis.

A special thanks to Continental Electrical Construction Co. for their assistance in preparing this article.

Paul Rozek, CPA, CFP

Paul provides tax research, consulting and compliance services to closely held businesses, tax-exempt organizations, individuals and fiduciaries. As a reviewer in the tax department, Paul is experienced in the preparation and review of all tax returns, including Forms 990 and 990-T. His clients include family offices, private foundations, trade associations, charitable organizations, schools, credit unions and other non-profit entities.

Paul provides tax research, consulting and compliance services to closely held businesses, tax-exempt organizations, individuals and fiduciaries. As a reviewer in the tax department, Paul is experienced in the preparation and review of all tax returns, including Forms 990 and 990-T. His clients include family offices, private foundations, trade associations, charitable organizations, schools, credit unions and other non-profit entities.